gTLD Statistics and Business Implications Q3 2015

gTLD Statistics and Business Implications Q4 2015 presentation is now available

The associated article can be found on CircleID

Top Level Domain Statistics and Business Implications Q3 2015 Overview

- Average prices were based on prices at the end of September retrieved from GoDaddy, United Domains and 101 Domains. If a TLD was not found on any of these three websites, an alternative source was used

- Average number of registrations per day is the same as in Q2 at 33

- .club continues to lead the market in both volume and revenue

- Top 25 TLDs account for over a third of revenue and volume

- Largest group of TLDs have between 1 to 5 daily registrations

- Number of TLDs that will exceed ICANN’s minimum yearly fee is 8 plus a couple exceeding dataset (low-price in exchange to future renewals)

- Largest group of TLDs are in the $ to $75 retail price range

- Average revenue of all gTLDs within the dataset is $365k

- Average retail prices ($35.16 to $83.82) within each tier differ yet the median price difference is minimal ($31.74 to $35.99)

- Tier 2 is the only tier with a strong correlation between price and volume

- Based on today’s data, 75% of TLDs are projected to operate at a loss for the next year, conservatively

Insights from gTLD Statistics and Business Implications Q3 2015

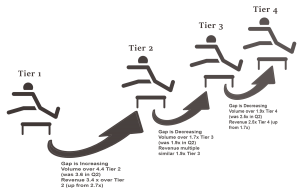

Tier 1: Trailblazers – A strong pack of leading TLDs who continue to grow the gap over the other three tiers

- Price is not propelling the volume, the caliber of the TLD is reflecting that registrants will choose and pay for a meaningful, relevant TLD

- Over two-thirds of geographic TLDs are in tier 1 and 2

- Yearly volume has increased quarter-over-quarter in both percentage and in volume

- Strong registration volumes along with price

- Surmise: Tier 1 TLDs value are understood by registrants and/or the registries have promoted the TLD so its value proposition is understood

Tier 2: Path Finders – Finding their way

- Price is a factor in determining the TLDs volume

- Difficulty is having registrants understand the value of the TLD and willing to pay for it. Tier 1 TLDs have this figured out

- TLDs that are similar and are first to market are 75% more likely to be in a higher tier

- Overall volume of transactions have declined from Q1 and Q2

- Average retail price of TLDs in this tier have declined in value

- Surmise: Tier 2 TLDs will need to put in a significant amount of work to become a Tier 1 TLD

Tier 3: Campers – Niche groups of TLDs

- A lot of niche TLDs where registries projected a lower volume and rightfully, increased price to make the TLD financially viable – expect that this will work

- Small increase in the number of registrations

- Big jump in the average retails prices as Tier 4 TLDs move upwards due to increased revenues again reflecting that registrants will purchase a meaningful, relevant TLD

- Surmise: Niche TLDs will be financially viable but those TLDs that are not niche focused have a lot of work ahead of them to be financially viable over the long-term and as more TLDs enter the market the work to move up will increase

Tier 4: Hikers – Determining a pathway up!

- Low daily volumes and retail registration prices

- Only tier with clusters of TLDs with Political TLDs such as .democrat, .republican, .vote, .voting and Military TLDs such as .army, .navy, .airforce

- Registration volume has increased

- Average retail price has declined

- Higher priced TLDs who have provided additional benefits or value add to registrants have moved to a higher tier

- Surmise: this tier is full of potential yet it needs to be acted upon. Adding additional benefits/platform may be beneficial. Also, with a note of caution, consideration of a low-price in exchange for volume may be a business model to be considered by TLDs in their tier

gTLD Business Implications Q3 2015 and the road ahead

- Revenues and volumes will continue to increase

- Volume of premium names will also grow in both volume and number of transactions

- 75% of TLDs will not be profitable for the next year based on today’s numbers

- More TLDs are still entering the market increasing competition and the need for registries to be more creative with a solid value proposition

- Tipping point has not been reached requiring the entire TLD industry to work together to bridge the gap to the outside world!

Please do not hesitate to contact us for any questions, insight or items to consider for future analysis.

Previous Post

Previous Post Next Post

Next Post